Account entries QSG

Our easy to use guide will get you up and running in no time!

This document offers guidelines on how to manage your accounting entries in relation to the Netcash system and processes. Please note that it is only a suggestion and is used at your own discretion.

11.1 Transaction Types and Associated General Ledger Transactions

There are five types of transactions which can occur on your Netcash account. These are listed below together with a brief description of each, and the associated general ledger ‘double entry’.

11.2 Accounting entries

The possible accounting entries that you may want to generate from these transaction types, together with a recommended GL Account will be illustrated in this document. In our suggested accounting setup, it is imperative that you set up your Netcash account as a Bank Account and as such reconcile it as you would any other bank account. A detailed Netcash Statement is available on the system for reconciliation purposes.

11.3 General Ledger Account list

A recommended chart of accounts to use for Netcash related transactions would be the following:

- Netcash cashbook. We suggest that you set up this Netcash Account in the cashbook and treat it as a ‘bank account’ as it is in effect a ‘Cash’ account. This will enable you to transact against your Accounts Receivable and Accounts Payable sub-ledgers.

- Accounts Receivable. Setup a sub-ledger for each of your customer/s.

- Income account to reflect the relevant income for which you are debiting.

- Bank account which is your bank account registered with Netcash.

- Fees account for fees charged by Netcash.

- Accounts Payable sub-ledger for each one of your creditors.

- Salary Control Account for salaries paid via Netcash

1.4 Transaction types and Associated General Ledger Transactions

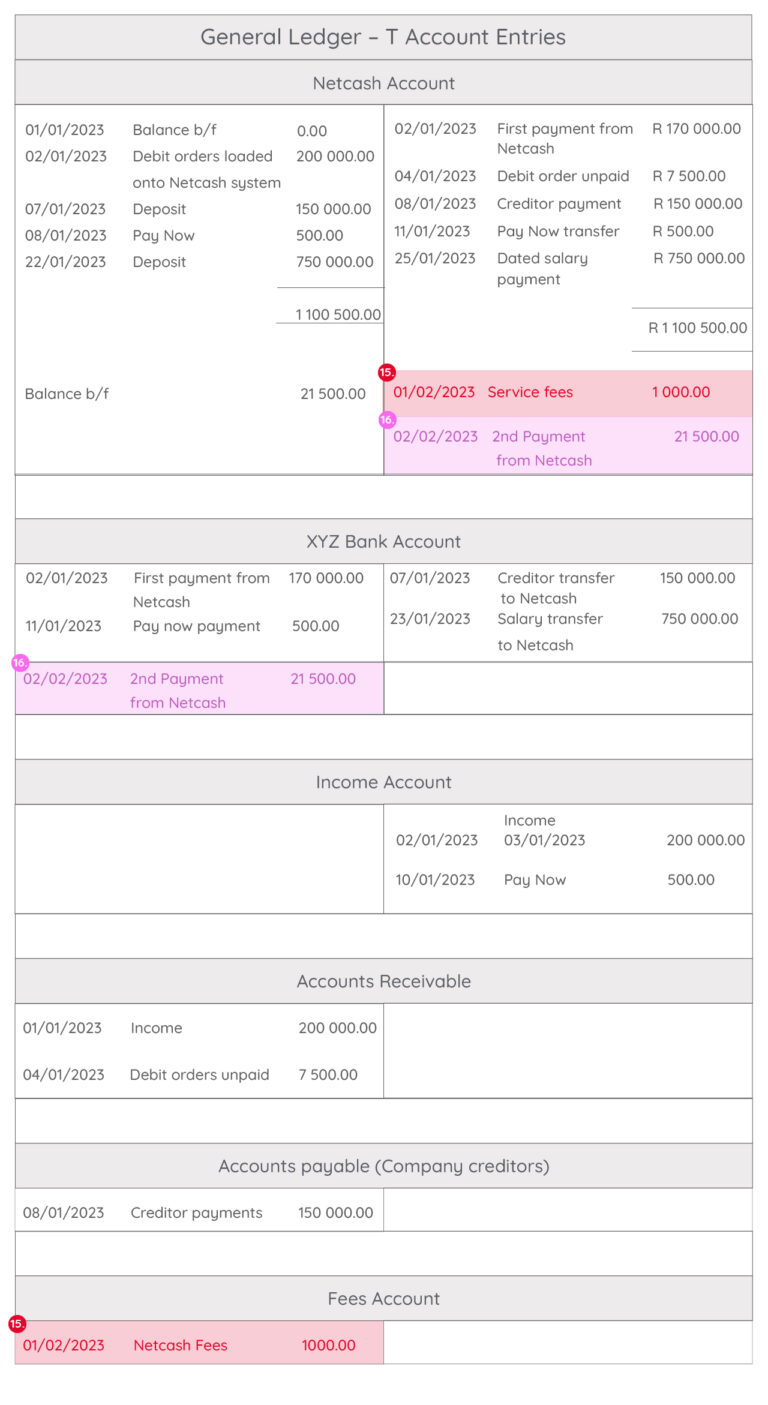

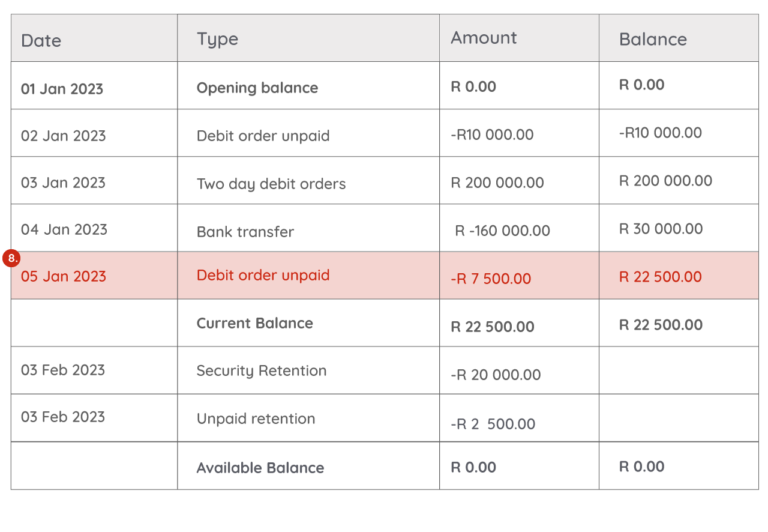

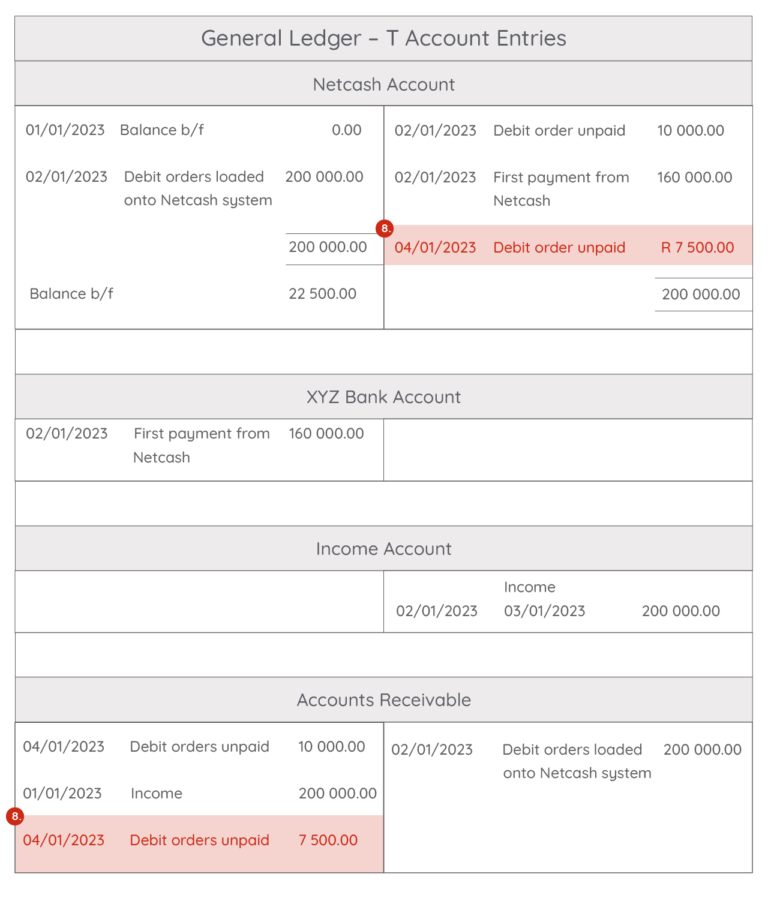

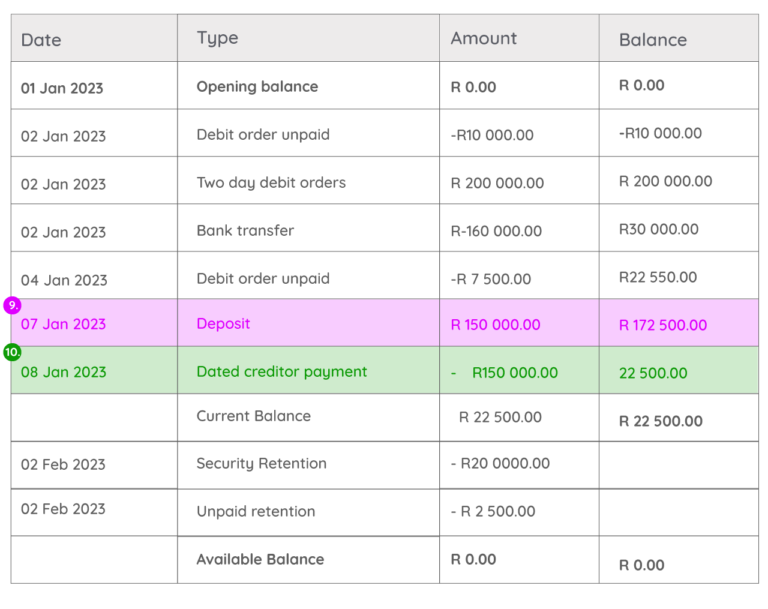

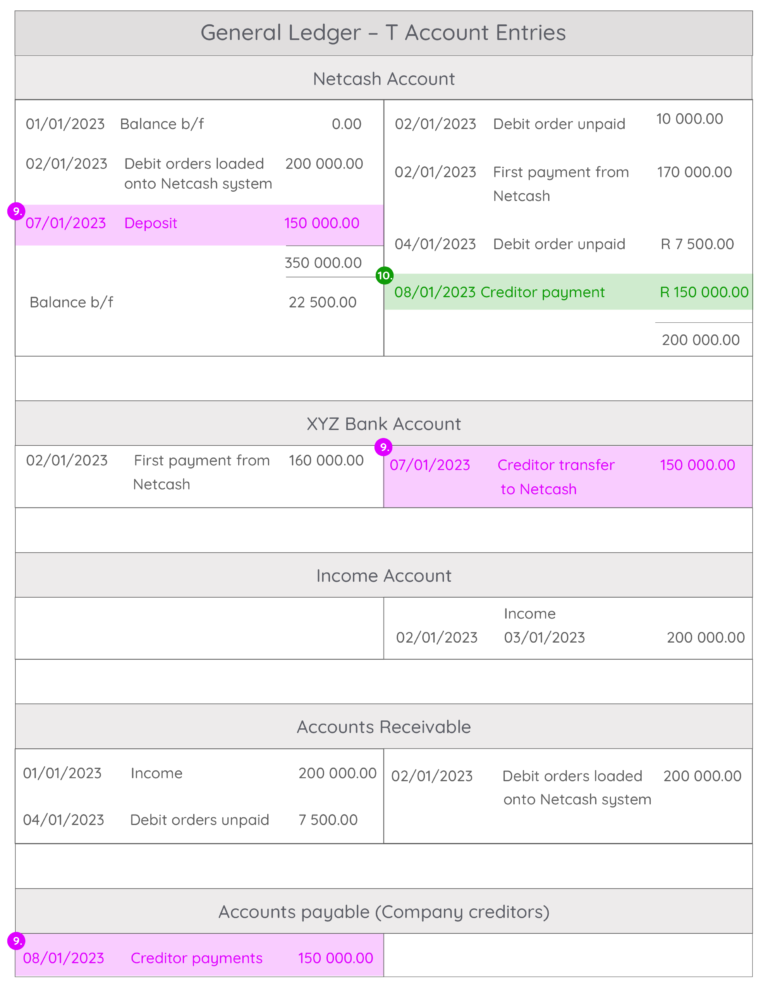

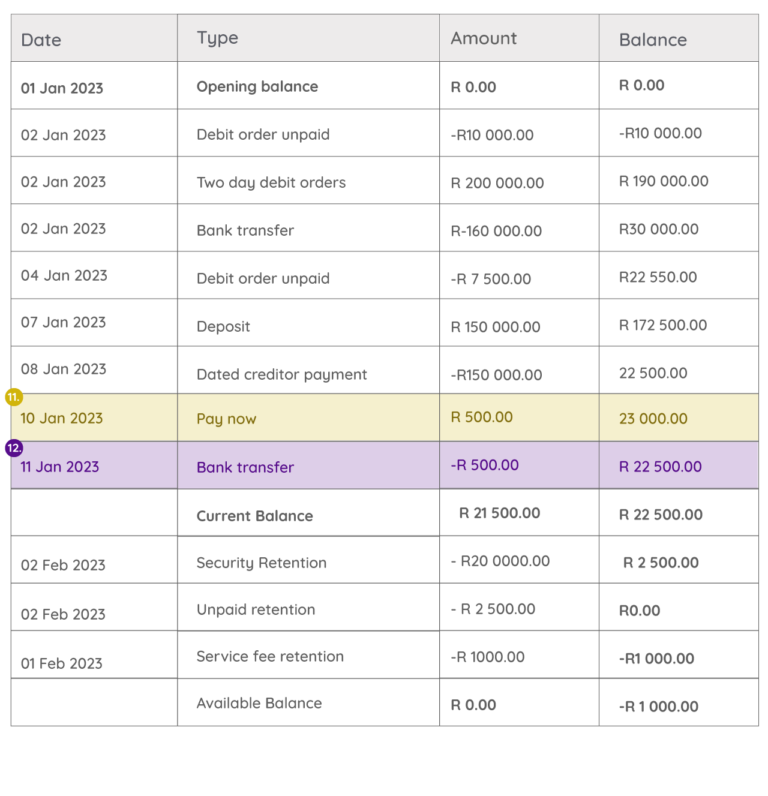

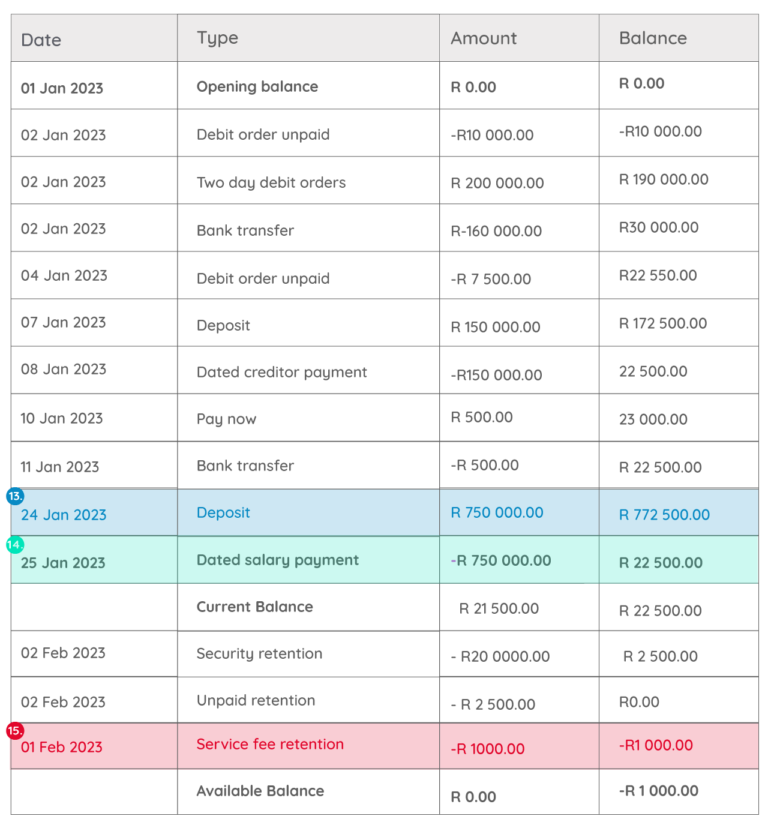

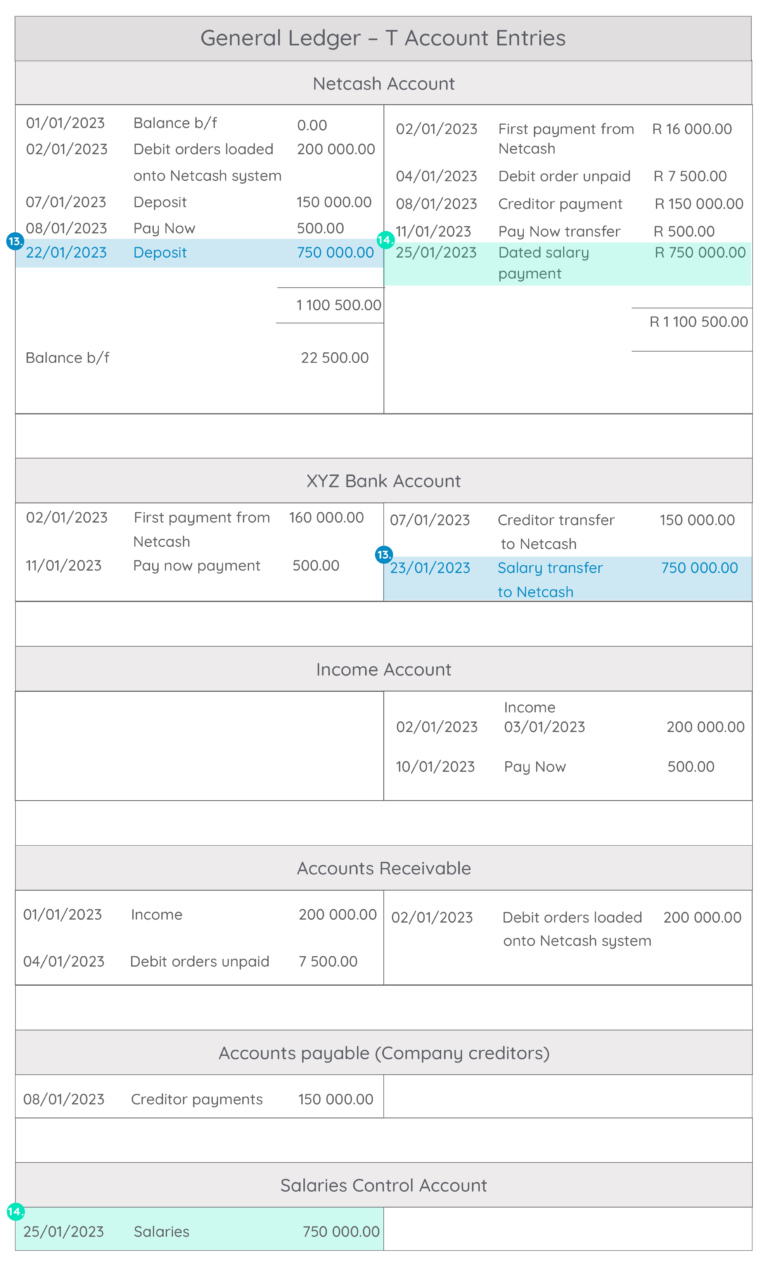

A simplified example of a Netcash Statement is shown below together with the standard accounting transactions which we recommend for each transaction type. A T-account general ledger illustrates the transactions using the values indicated in the Netcash statement.

1.5 Transaction types and Associated General Ledger Transactions

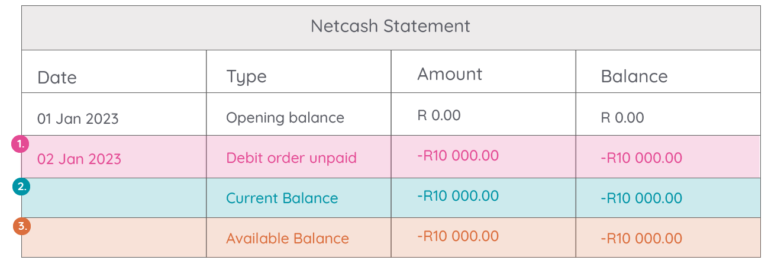

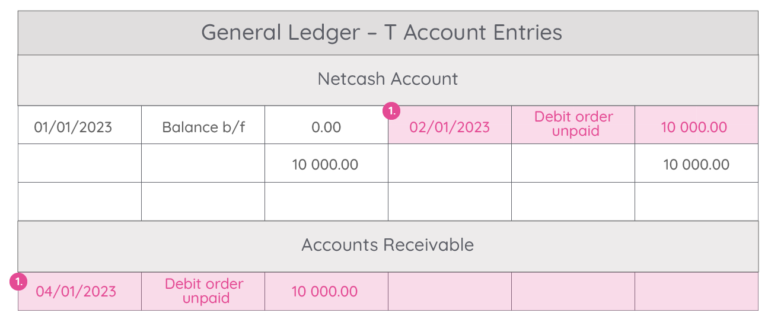

1.Debit orders submitted by the account holder which have not been honoured (e.g. insufficient funds, account closed, etc)This transaction represents any unpaid debit orders for various reasons, run against debtors. Again, this will decrease the value of the final amount owed to you by Netcash.

- Debit Accounts Receivable (per debtor)

- Credit Netcash Account

2./3. Please note that this example illustrates that debit order unpaids should NOT be considered batch related when doing recons. Recons should always be done off the Netcash statement and NOT the batch report. This can be seen in the next example.

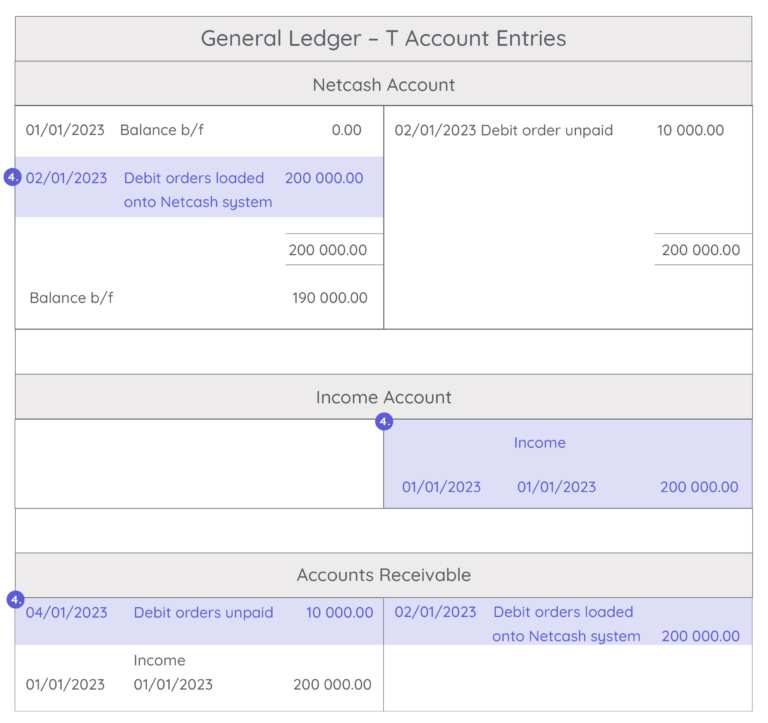

4. Same day/ Two day debit orders – These are debit orders which you load onto the Netcash system to collect funds from customers.

Raise a virtual receipt transaction for the actual value of the debit order in the ‘Netcash Cashbook’, which will zero out the various debit order customer. The Netcash Account balance will now reflect the expected asset prior to fees.

Debit Netcash Account

- Credit Accounts Receivable (per debtor)

Raise the debtors in the Account Receivable sub-ledger prior to generating the Debit Order file

- Debit Accounts Receivable (per debtor)

- Credit Income (relevant income account per business)

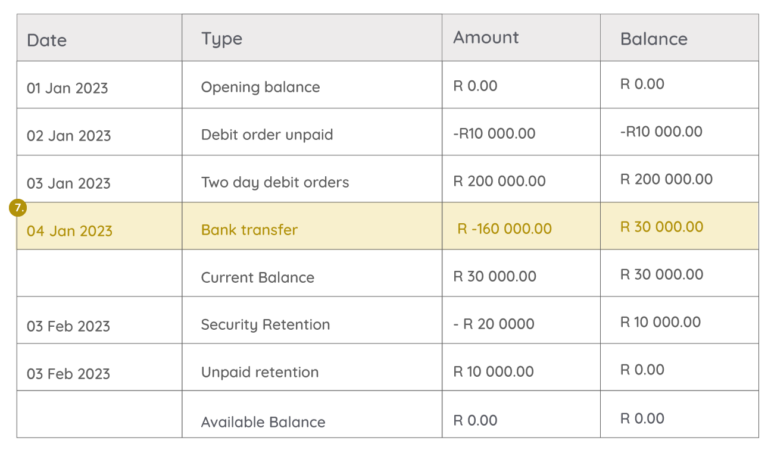

3. The Available balance is the balance on the Netcash account is which available to be transferred out of the account.

2./5./6. The Current balance is the amount still being held on the Netcash account. This amount is made up of all Retentions and the Available Balance. In the case of the example the Current balance consists of the two retention amounts which are only due to be released on 3 Feb.

Please take note that the example illustrates how any negative amount, in this case, an unpaid transaction, reduces the available balance for release.

It is vital to understand that an unpaid debit does not necessarily relate to the most recent debit order batch processed. Again, in the case of this example, the unpaid debit order on the 2 Jan relates it no way to the batch run on 3 Jan. This unpaid might be from any one of a number of previous batches and will consequently reduce the available balance and thereby the amount transferred for the subsequent batch.

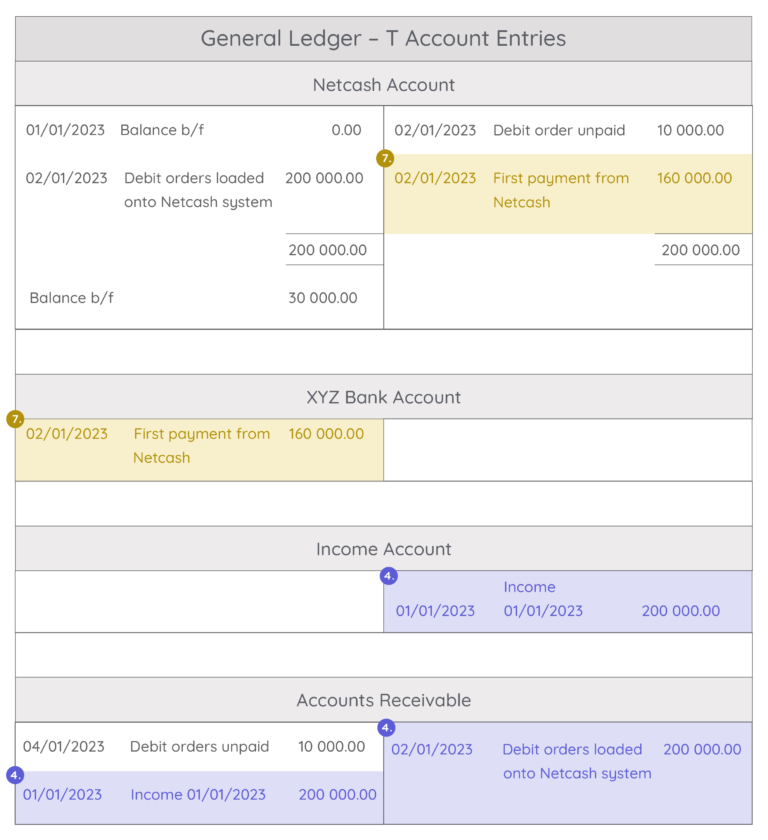

Bank Transfer – Payment by Netcash to the account holder, of funds available of debit orders collected on their behalf. This transaction represents funds in the Netcash account less any retentions, having already taken into account fees and unpaid transactions.

- Debit Bank account

- Credit Netcash Account

8.Debit orders unpaid

Debit orders submitted by the account holder which have not been honoured (e.g. insufficient funds, account closed, etc)

This transaction represents any unpaid debit orders for various reasons, run against debtors. Again, this will decrease the value of the final amount owing to you by Netcash.

- Debit Accounts Receivable (per debtor)

- Credit Netcash Account

9./10. Please note that this example illustrates that debit order unpaids should NOT be considered batch related when doing recons. Recons should always be done off the Netcash statement and NOT the batch report. This can be seen in the next example.

11./12. Pay Now

Payments into the Netcash system from Netcash online payment services e.g. EFT, Instant EFT, credit cards

- Debit Netcash Account

- Credit Income Account

13./14. Same day/ Dated Salary Payments

Your salaries are paid according to data uploaded and released by you onto the Netcash system.

Record the salaries in the Salaries Control sub-ledger prior to generating the payment file

- Debit Expense (relevant expense account per business)

- Credit Salaries (per salary)

Raise the payment of the salaries when you upload the payments onto the Netcash system. These payments can be made against funds available in your Netcash account. Debit Accounts Payable (per salary)

- Debit Salaries Control (per salary)

- Credit Netcash Account

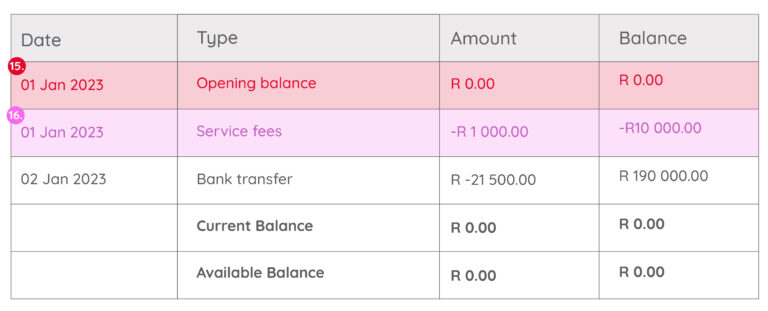

15. Service Fees

These are pre-determined and agreed fees for transactions processed on your behalf on the Netcash system.

Service fees are accumulated during the course of the month and reflect as a retention amount. Service fees are held as a negative amount in retention and only invoiced at the beginning of the following month.

Service Fees

These are pre-determined and agreed fees for transactions processed on your behalf on the Netcash system.

This transaction raises the fees payable to Netcash. This decreases the expected gross debit orders and now reflects the net money receivable from Netcash. The fee expense is also accounted for. This transaction can be obtained from your statement obtainable from the Netcash website.

- Debit Netcash Fees expense

- Credit Netcash Account

We trust that this guide can assist you with those questions which you may have regarding accounting entries. Should you have any other accounting related queries, these can be directed to your Relationship Consultant or accounts department on 0861 338 338.