Source of Funds

FINANCIAL INTELLIGENCE CENTRE ACT (“FICA”) NO. 38 OF 2001

CUSTOMER DUE DILIGENCE REQUIREMENTS – FACT SHEET

What is the act all about?

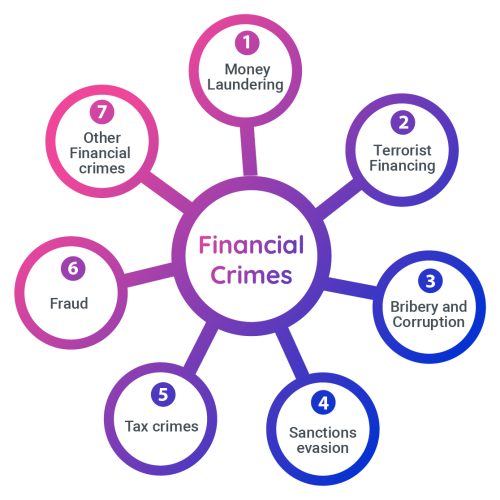

The PRIMARY GOAL of CRIMINALS, once they commit their crimes, is to DISGUISE THE ORIGINS of their illegally obtained money.

FICA aims to combat financial crimes by requiring “Accountable Institutions” (which includes Netcash, since Netcash is a participant in the South African National Payment System) to identify and verify clients, maintain records, and report suspicious transactions to the Financial Intelligence Centre (“Centre”).

The Acts’ PRIMARY PURPOSE is to prevent and detect the proceeds of criminal activities passing through the South African National Payment System, to avoid money laundering, funding of terrorist activities and weapons of mass destruction.

Financial Crimes

How the act works

- Accountable Institutions are required to comply with its various obligations, such as customer due diligence, reporting suspicious activities and record keeping, amongst others.

- Customer Due Diligence requires Netcash to implement robust customer due diligence control measures, including verifying client identities and monitoring transactions.

- Reporting Suspicious and/or Unusual Activities to the Centre is required from all businesses in South Africa.

- Record Keeping; Netcash must maintain accurate records of client information and transactions.

- Compliance and Supervision; the Centre monitors and enforces compliance with the FICA regulatory requirements. Fines often result in the tens of millions of rands!

Benefits of FICA compliance

- Protection of the National Payment System; FICA helps to ensure the integrity and stability of South Africa’s financial system.

- Combating Financial Crime; by detecting and preventing financial crimes, FICA contributes to a safer and more secure environment for businesses and citizens.

- International Compliance; FICA helps South Africa comply with the international standards for combating money laundering, terrorist- and proliferation financing.

What do the customer due diligence requirements entail?

Netcash:

- may not do business with anonymous clients and clients acting under false or fictitious names.

- must comply with the identification requirements of clients and other persons.

- must understand and obtain information on the business relationship with each client.

- must perform additional due diligence relating to legal persons, trusts and partnerships.

- must conduct ongoing due diligence on its clients.

- must perform enhanced due diligence should it have any doubts about the veracity of previously obtained information and when reporting suspicious and unusual transactions to the Centre.

- may not do business with a client when it is unable to conduct customer due diligence.

- must perform enhanced due diligence on foreign politically exposed persons (FPEP), since they are regarded as higher risk individuals.

- must perform enhanced due diligence on domestic politically exposed persons (DPEP) and prominent influential persons (DPIP), since they are regarded as higher risk individuals.

- must perform enhanced due diligence on FPEP and DPEP family members and known close associates, since they are regarded as higher risk individuals.

What is a business relationship?

A Business Relationship is an arrangement between a client and Netcash (an Accountable Institution) for the purpose of concluding transactions on a regular basis.

Understanding and obtaining information on the business relationship

FICA requires that when Netcash engages with a prospective client to establish a business relationship, that it must, in addition to the identification and verification steps followed in accordance with its Risk Management and Compliance Programme, obtain information to reasonably enable it to determine whether future transactions that will be performed in the course of the business relationship concerned are consistent with Netcash’s knowledge of that prospective client. This information will describe:

- the nature of the business relationship concerned;

- the intended purpose of the business relationship concerned; and

- the source of the funds which the prospective client expects to use in concluding transactions in the course of the business relationship concerned.

What is the potential source of funds used by the client in its business

1. Sale proceeds from Goods and/or Services

2. Commission Earned

3. Dividend Income

4. Donations and/or Sponsorship

5. Fees Earned

6. Grant

7. Investment Income or Capital

8. Interest Income

9. Insurance Payout

10. Loan

11. Membership Fees

12. Proceeds from Asset Disposal

13. Rental Income

14. Rewards Earned

15. Royalty Income

16. Shares

17. Other

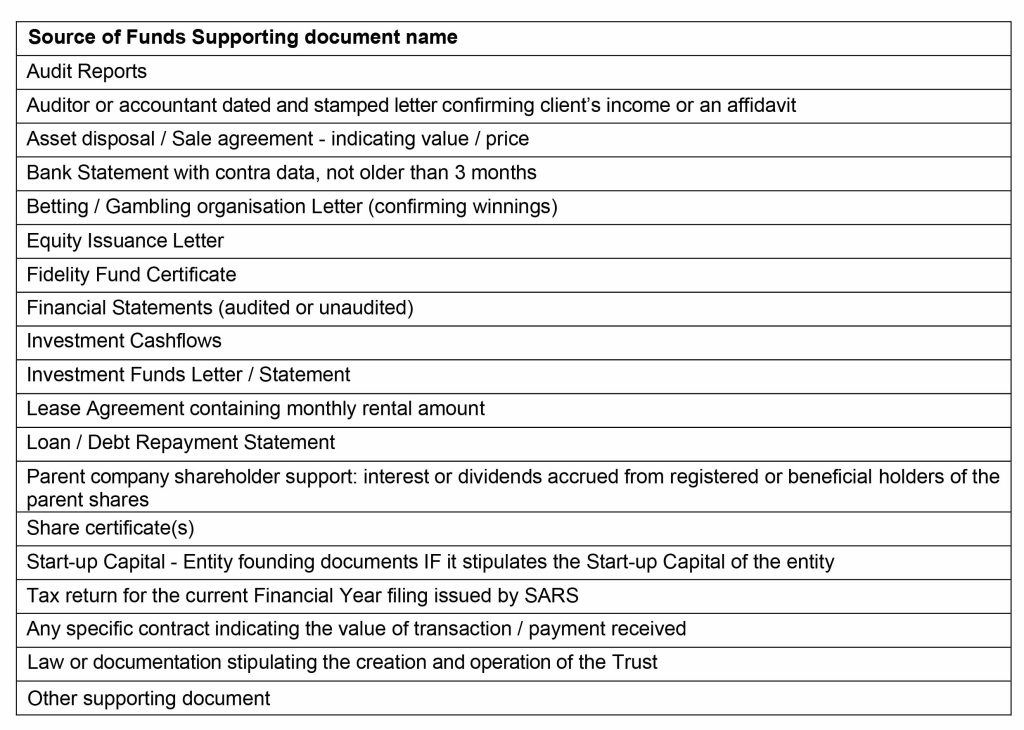

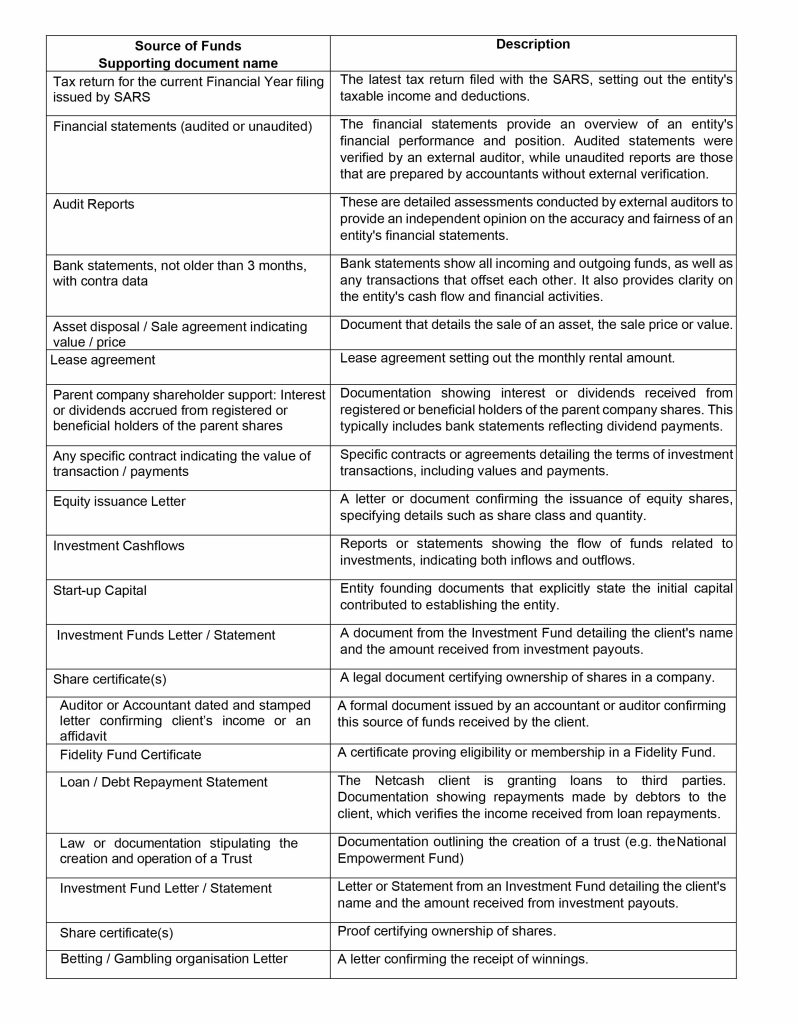

Any of the below listed documents can be used as evidence in support of the selected source of funds for the client’s business