Ultimate Beneficial Ownership

A Guide for Netcash Clients

Netcash is committed to providing secure, compliant, and transparent payment services. Part of that responsibility includes complying with South African legislation that requires us to identify and verify the Ultimate Beneficial Owners (UBOs) of all businesses using our platform.

This guide explains what a UBO is, why we need your UBO information, and what documents are required.

What is an Ultimate Beneficial Owner (UBO)?

A UBO is always a natural person — not a company, trust, or other legal entity.

A UBO is any individual who:

- Owns 5% or more of a business (directly or indirectly)

- Exercises significant influence or effective control over the business

- Benefits financially from the business

- Controls management or strategic decision‑making where no clear ownership threshold exists

Even where ownership is layered through companies or trusts, the UBO is the person at the end of the chain.

Why Netcash Must Collect UBO Information

As an Accountable Institution under the Financial Intelligence Centre Act (FICA), Netcash is legally required to:

- Identify and verify the natural persons who own or control entities using our services

- Keep accurate and up‑to‑date beneficial ownership records

- Prevent the misuse of financial services for money laundering, terrorist financing, tax evasion, procurement fraud, and other economic crimes

These requirements come from:

- The Financial Intelligence Centre Act (FICA)

- The Companies Amendment Act (2023)

- The General Laws (Anti‑Money Laundering & Combating Terrorism Financing) Amendment Act (2022)

These laws align South Africa with global FATF standards and apply to all accountable institutions.

Why UBOs Must Provide an ID and Proof of Address

FICA requires Netcash to perform Customer Due Diligence (CDD), which includes:

✔️ Verifying Identity

We must confirm the full legal identity of each UBO through official identification documents.

✔️ Verifying Residential Address

Proof of address ensures:

- Accurate risk assessment

- Protection against identity and synthetic‑identity fraud

- Reliable investigation if suspicious activity arises

Without these documents, we are legally prohibited from onboarding or continuing a business relationship.

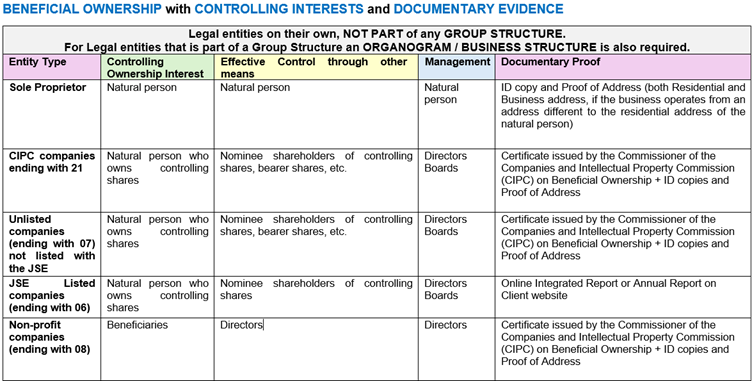

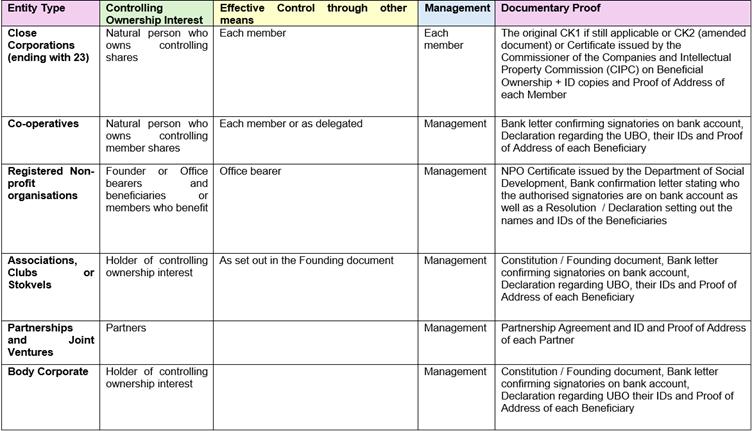

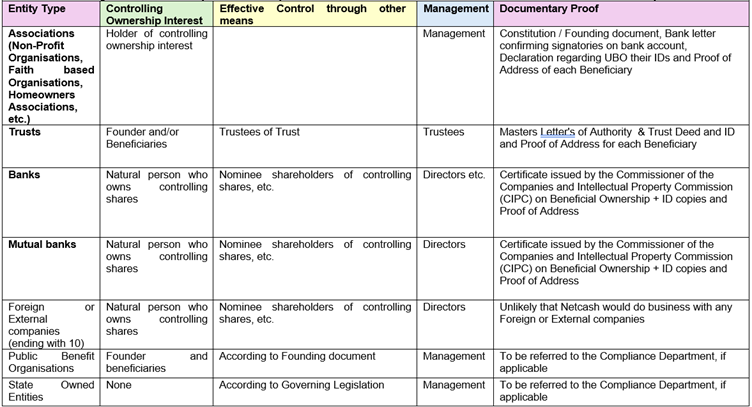

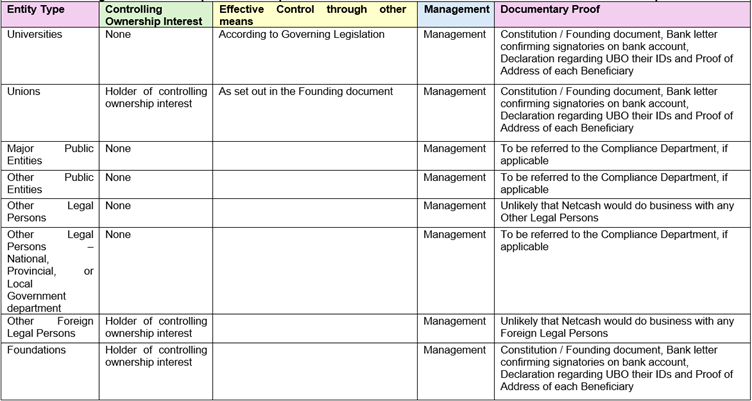

Documents Required for UBO Verification

When onboarding or updating your information, Netcash will request:

- ID copy of each UBO (SA ID or passport)

- Proof of residential address for each UBO

- Company Beneficial Ownership structure, including:

- Share registers

- Trust deeds

- Partnership agreements

- Organograms (for groups or layered structures)

We may request additional supporting documents if the ownership structure is complex.

All information is treated with strict confidentiality and used only for compliance purposes.

How UBO Verification Protects You

Collecting UBO information helps to:

- Ensure transparency and accountability

- Protect your business from being impersonated or misused

- Reduce fraud risks on the Netcash platform

- Maintain secure financial ecosystems for all clients

Our controls help safeguard Netcash, your business, and the broader financial system.

In Summary

Netcash requires UBO information because it is:

- Legally mandatory under FICA and other South African laws

- Essential for preventing financial crime

- Required for a safe and compliant payments environment

Thank you for helping us maintain the highest standards of security and compliance.