Sage 200 Evolution

Our easy to use guide will get you up and running in no time!

Index

- How to issue a service key

- Insert your Netcash Account Number and Service Keys

- Create a company bank account

- Prepare your suppliers for Netcash

- Process Automatic Payment and Remittance Batch

- Authorising creditor batches

- Process invoices with Netcash payment options (Pay Now)

- Import your Netcash Bank Statement using Bank Manager

- Update an Agent’s details

How to issue a service key

Service Keys are a vital part of system security and should be treated with the utmost confidentiality. Sage 200 Evolution requires 4 service keys:

- Account service

- Creditor payments

- Pay Now (Billing)

- Risk reports

Note: Risk reports service key is not mandatory but will be required to make use of this service.

A) Add an Account service key in Netcash

- Select Account profile.

- Click on Netconnector > Account service.

- Tick the Active box.

- Insert an email address to receive notifications.

- The Postback URL is unticked.

- The Postback URL is Blank.

- The statement download option is set to None.

- Click on the Submit button.

- The service key is generated and emailed to the email address linked to the service key.

B) Add a Creditor service key

- Select Account profile.

- Click on Netconnector > Creditor payments.

- Tick the Active box.

- Insert an email address to receive notifications.

- The Postback URL active box is unticked.

- The Postback URL is Blank.

- Choose from the following options: Ignore errors, Auto forward action date or Lock batch on upload. (See notes below for detail).

- Click on Submit.

- The service key is generated and emailed to the email address linked to the service key.

Notes: Select Ignore errors if you would like Netcash to process payments to valid bank accounts and ignore invalid bank accounts. Leaving this option unticked will result in all payments rejecting if any one payment is invalid.

Auto forward action date will move your payments to the next valid action date if you have missed your cutoff time.

Lock batch on upload will not allow any editing of supplier details once the supplier batch has been received by Netcash.

C) Add a Pay Now service key

- Select Account profile.

- Click on Netconnector > Pay Now.

- Tick the Active box.

- Insert the email address to which Netcash must send reports.

- Activate test mode if you do not want to process live transactions yet.

- Choose your payment options: Credit card and QR | Bank EFT | Cash | Instant EFT | 1Voucher | Payflex.

- Predefined URL group set to None.

- Click on Notify my customers if you would like Netcash to confirm acceptance of their payment.

- Click on Submit.

- Once the service key is generated it can now be inserted into Sage 200.

D) Add a Risk report service key

- Select Account Profile.

- Click on Netconnector > Risk reports.

- Tick the active tick box and insert an email address.

- Insert the nominated enquirer.

- The postback URL is unticked.

- Choose whether to Ignore errors.

- Select Submit.

- The service key is generated and emailed to the email address linked to the service key.

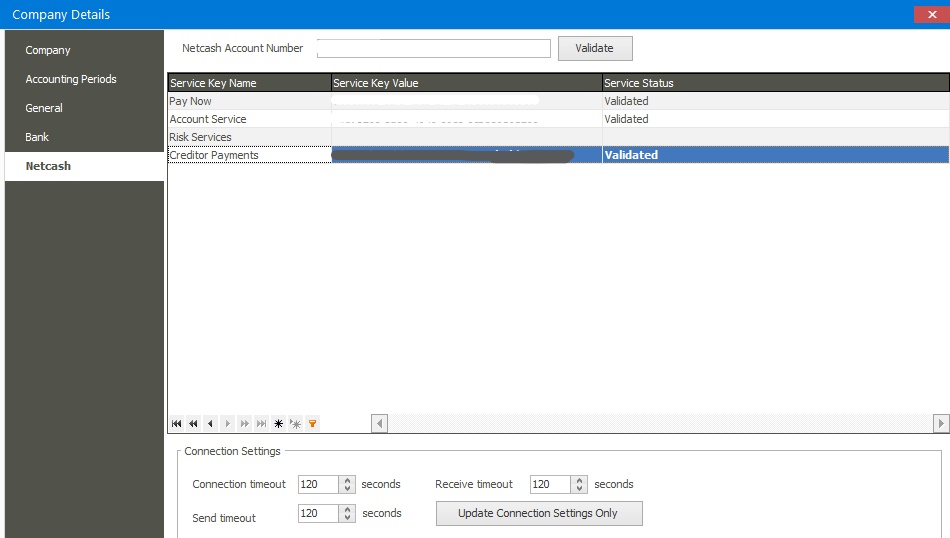

Insert your Netcash account number and Service Keys

- Navigate to Common | Company Details.

- Click on the Netcash tab.

- Enter your Netcash account number.

- Enter your service keys in the grid to the corresponding service and click on the validate button.

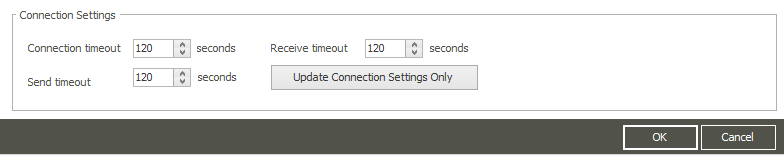

The Connection Settings section allows you to set the maximum time the application will wait for a network connection to be established. If the timeout expires or a network error is encountered, it will still allow you to send or print the invoice or associated document without the Netcash banner. This will ensure the customer does not have to wait for a restored connection to pay for their goods.

Click on the Update Connection Settings Only button to save your connection settings.

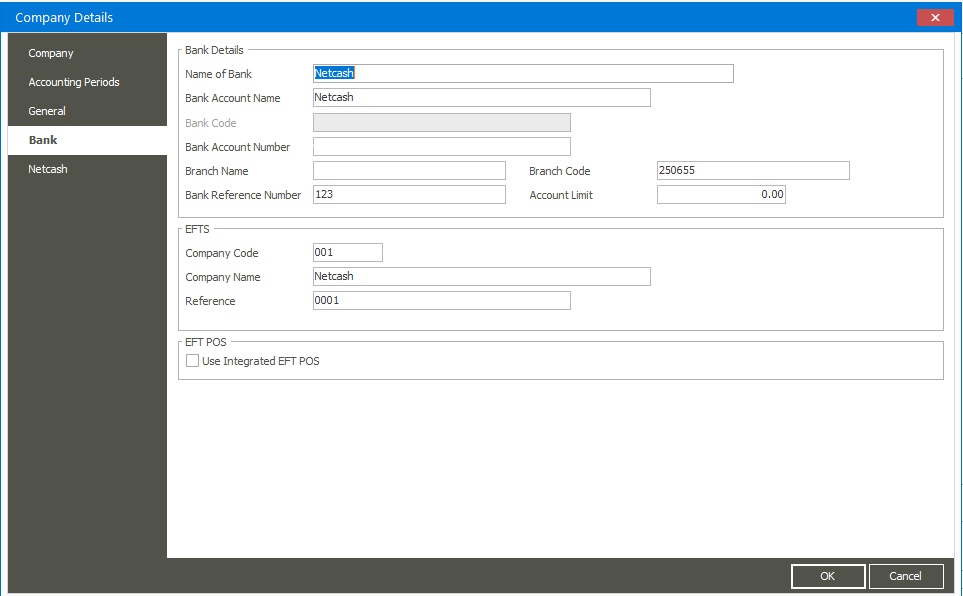

1. Navigate to Common | Company Details.

2. Click on Bank.

3. Enter your Company bank details

Note: If the Netcash Pay Now service is being utilised the Netcash payment methods will be visible on the invoice and not your Bank account details. If Pay Now is not being utilised the banking details captured will be displayed on the invoice.

4. EFTS – Create company code, reference, and name.

Create a company bank account

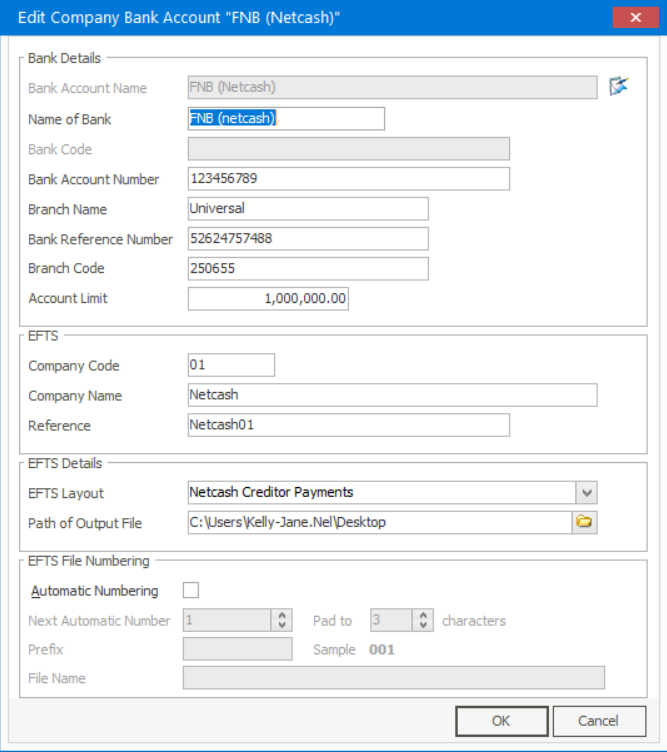

1. Navigate to Common | Company Bank Accounts.

Enter your company bank account details. In the bank account name field it is recommended to add Netcash as an additional name in this field to easily identify the EFTS bank when creating a automatic payments and remittance batch. Example: Your bank (Netcash)

EFTS – add company code, reference, and name. (Capture EFTS details as per Company details – Bank)

In the EFTS Details section, select the default Netcash Creditor Payments layout.

Specify the path for the output file.

Click on the OK button to save the Company Bank account.

Ensure that a Netcash cash book is created in the General Ledger for allocation purposes. (Navigate to maintenance> General Ledger> Accounts)

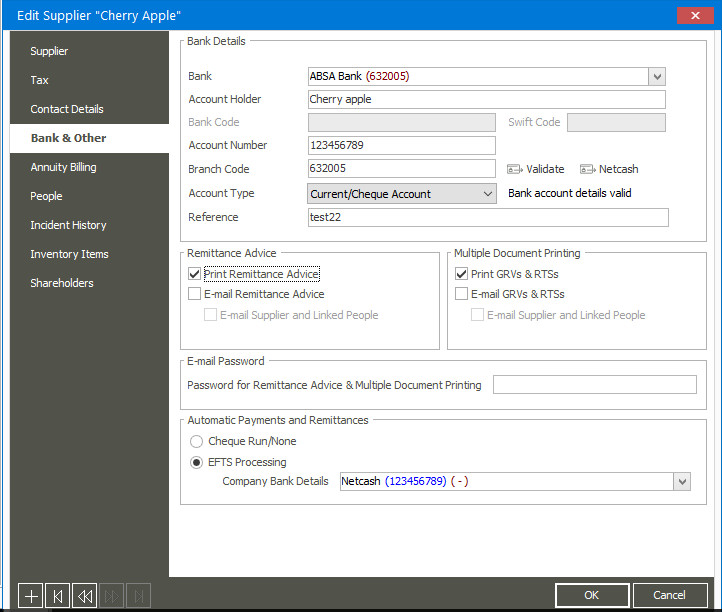

Prepare your suppliers for Netcash

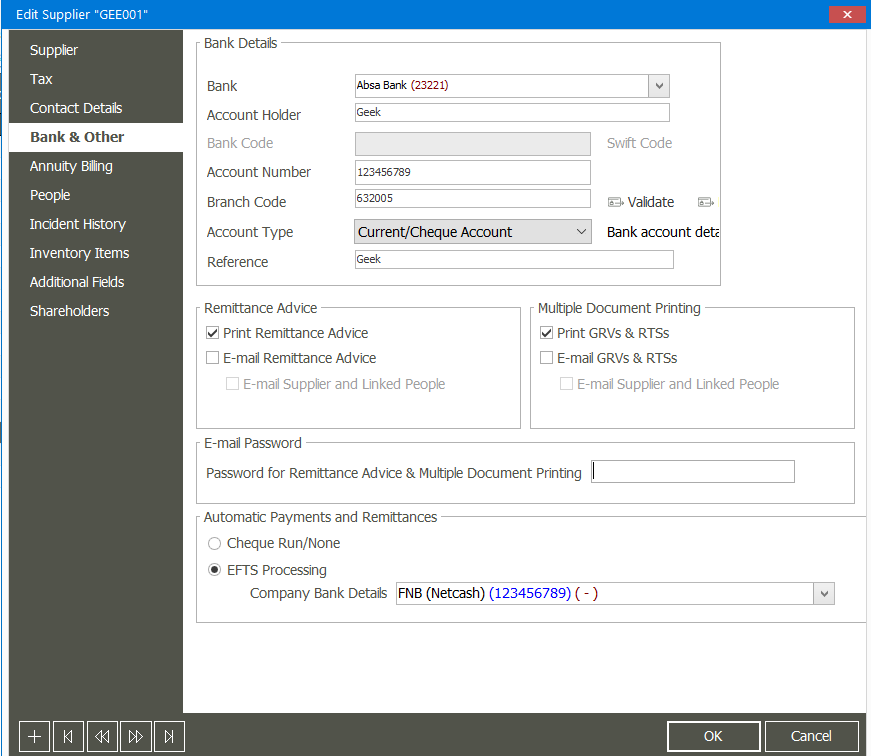

- Navigate to Accounts Payable | Maintenance | Suppliers.

- You can either add a new supplier or edit an existing supplier.

- Navigate to the Bank & Other tab.

- Enter the customer’s account details in the respective fields.

- It is important to link the bank account to an Account Type.

- A message displays in red, informing you that the bank account details have not been validated.

- Click on the Validate button.

- A message will return stating that the bank details are valid or that the bank details could not be verified. If it returns a message that the bank details could not be verified, just double check your selections, or contact the supplier.

- EFTS processing select Netcash as the company bank details form the drop-down menu.

Process Automatic Payment and Remittance Batch

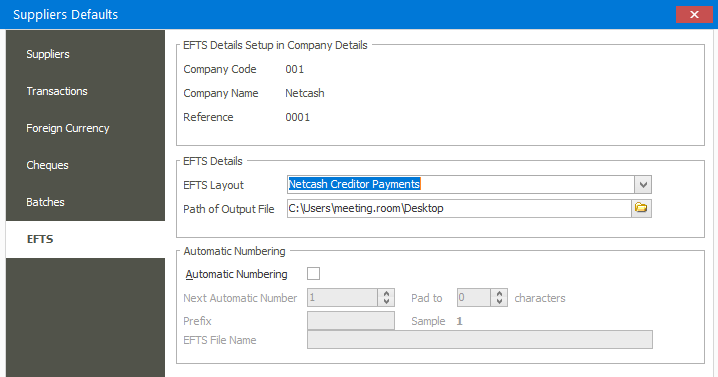

- Before you can get started processing creditor payments, it is important to check your EFTS Default settings.

- Navigate to Suppliers | Maintenance | Defaults| EFTS

- The following screen displays. Ensure that you select the dedicated Netcash Creditor Payments layout in the drop-down menu.

- Also specify a destination folder for the EFTS Output file.

- Click on Ok

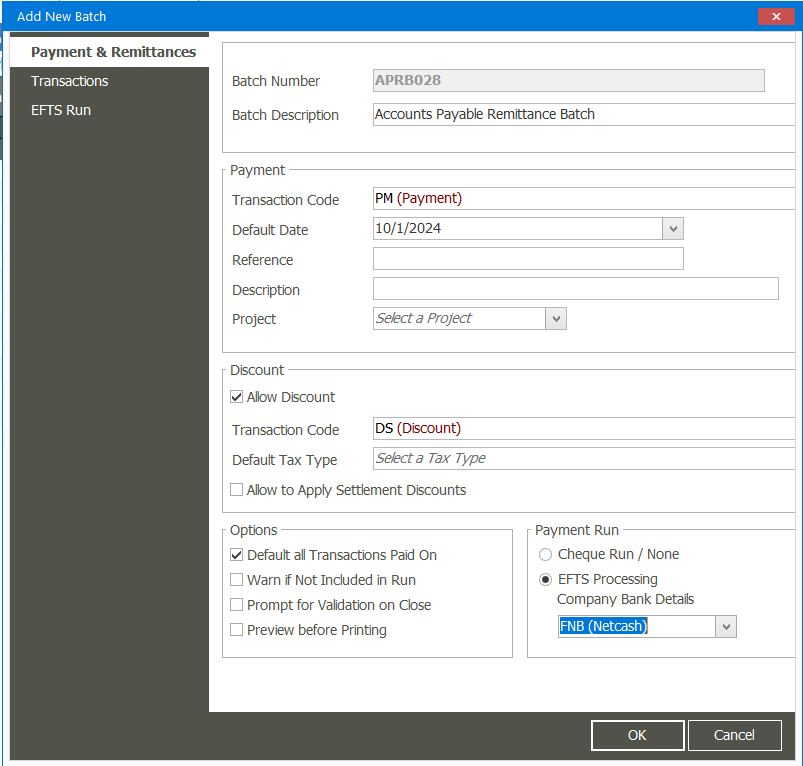

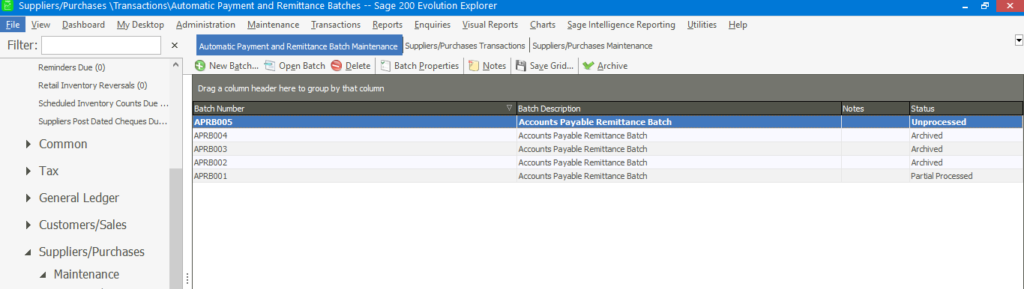

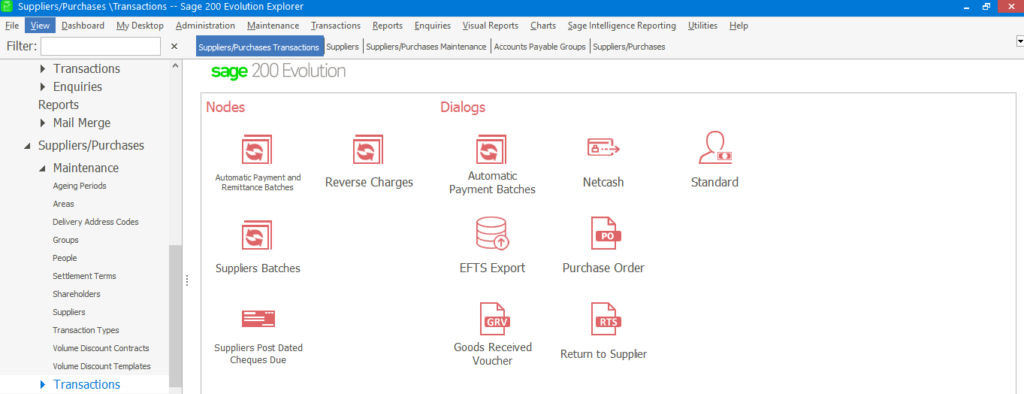

Navigate to Suppliers | Transactions | Automatic Payment and Remittance Batches.

Payment & Remittances screen

- Add a batch description – such as Accounts payable batch.

- Select your transaction code, ensure the transaction code is selected for your Netcash account in your general ledger.

Note: In Sage Evolution, Transaction Codes are used within Automatic Payment and Remittance batches to categorise and track different types of transactions, especially when using EFTS (Electronic Funds Transfer) processing. These codes help in organising and identifying payments and remittances for suppliers, ensuring accurate record-keeping and reconciliation

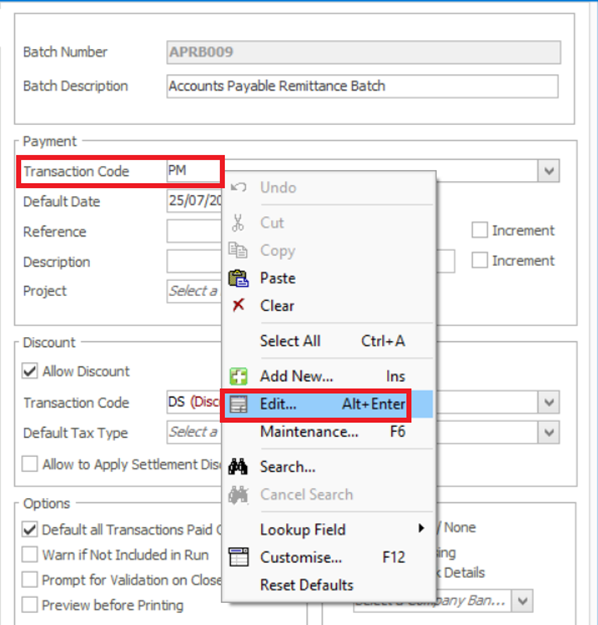

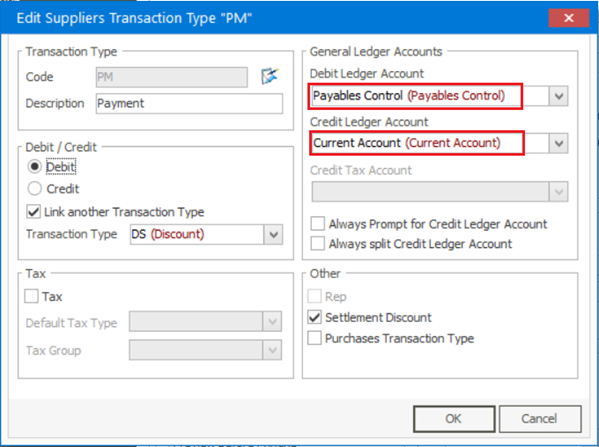

Right-click on the PM transaction type and Edit

Select the Netcash bank account on the Credit Ledger account field

Select the correct account for the Debit Ledger

- Select a date

- Add a reference: bank statement reference for creditors

- Description: describing supplier batch_ example Creditors 24 06 25

- Payment run: EFTS processing select your Netcash bank details

- Click on ok

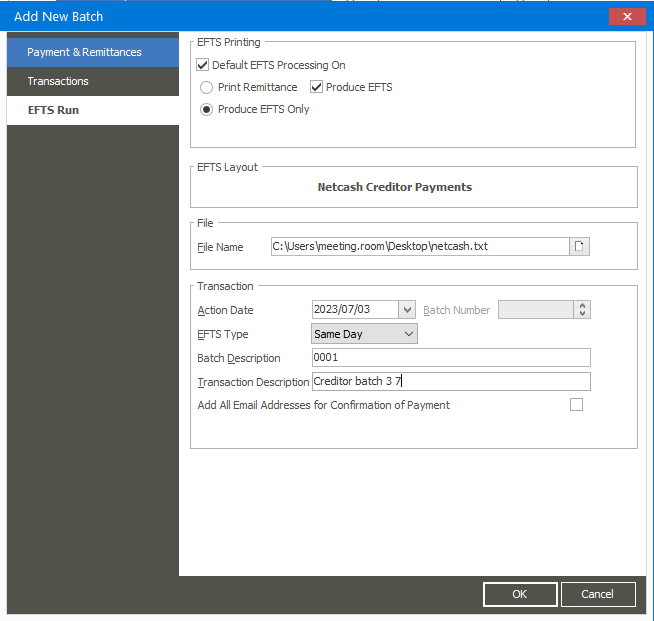

EFTS run screen

- EFTS Run section ensure the Produce EFTS option is selected.

- EFTS layout: Netcash creditor payments will be displayed

- File name: as set in your EFTS default layout

- Action date: action date for your supplier batch

- EFTS Type: Select either a sameday or dated batch

- Batch description: Name of your batch that will be displayed in Netcash

- Add a transaction description

- Click on ok

Transactions

- Select either by range to include creditors to the batch or alternatively search for creditors individually

- Click on ok

Process your Batch

- A list of creditors selected for the batch will be displayed. Creditors can be selected at invoice level (Configure payments)

- Produce EFTS to be ticked.

- Reference to be added if field is blank (failure to add a reference will result in the batch failing to Netcash)

- Description:

- Click on process to send the batch to Netcash

- The batch will be sent to Netcash.

- If the batch did not upload to Netcash due to connection issues, it is possible to manually upload the output file directly into Netcash.

- Check your Netcash batch file upload report for any batch errors such as invalid bank accounts. Log in to your Netcash account and navigate to Account profile| Integration tools| Batch file upload report.

Authorising creditor batches

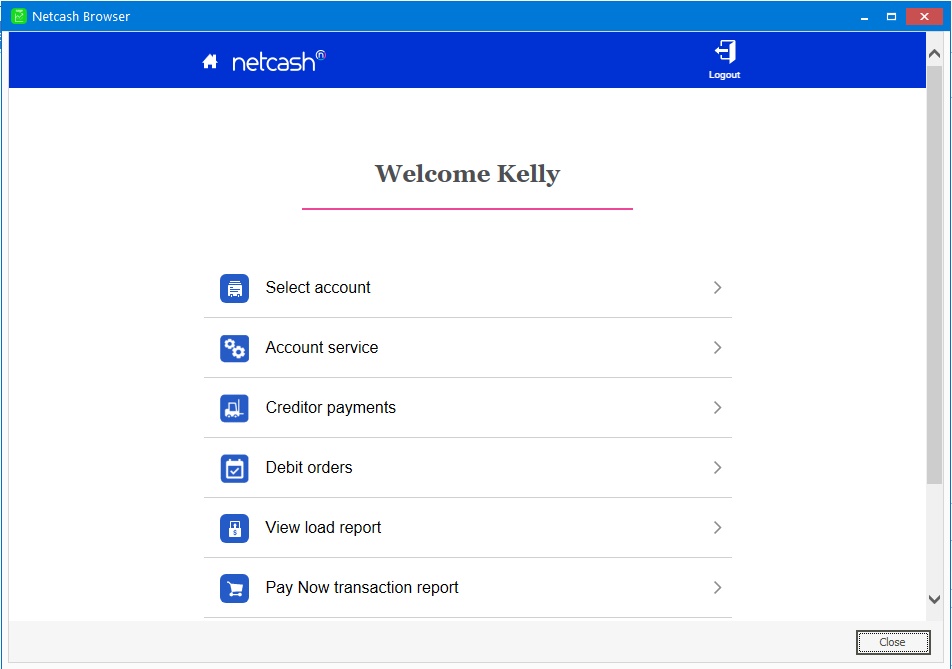

- Select Services.

- Select Payments from the dropdown menu.

- Click on Creditors > Creditor batches.

- The list of creditor batches will be displayed.

- Click on the Authorise button next to the batch that you would like to authorise.

- The Confirm batch authorisation screen is displayed. This is a summary of the creditor batch including charges, notifications and a choice of funding options:

- Use the available balance if there is sufficient credit in your Netcash account.

- Will make a bank transfer if you need to fund the Netcash clearing account for payment.

7. Read and accept the terms and conditions, then click on Authorise.

- Should you elect to pay using the available balance you will then be re-directed to the Confirm Batch authorisations screen.

- Insert the One Time Pin (OTP) sent to your cell number or Google authenticator pin.

- Click OK.

- Your creditor batch is now authorised and will be scheduled to run on the selected date.

Note: If you require additional authorisers, please inform them to authorise the batch before the cut-off.

- Click Authorise.

- Insert the One Time Pin (OTP) sent to your cell number or Google authorisation pin.

- Your creditor Batch is now authorised and will be scheduled to run on the selected date.

Note: One Time Pins are session based. This means that if you are logged in to your Netcash account, you can use the same OTP to authorise. Where multiple authorisations are required, only the first authoriser needs to insert the OTP. Alternatively 2 factor authentication may be used to authorise the payments batch.

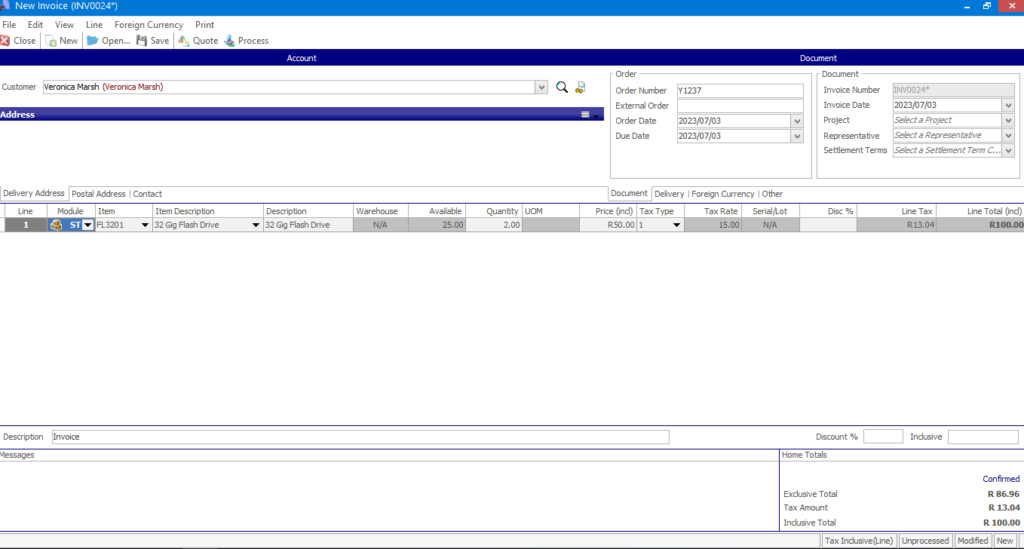

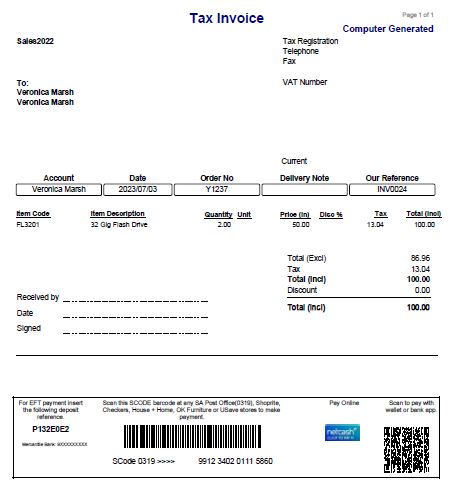

Process invoices with Netcash payment options

- Navigate to Inventory | Transactions | Invoice.

- The following screen displays:

- Complete the invoice screen with the necessary information, such as:

-

- Customer Order Numbers

- Inventory items

- Quantities

- Additional Charges

- Click on the Process button.

- The system will ask you if you want to print the invoice, click on the Yes button.

- The Netcash banner will be displayed in the footer on the invoice.

7. The P Number is automatically generated by Netcash and allocated to the invoice. It is unique to the invoice and is the reference number for the transaction.

- For EFTS payments, the customer will use this number as the payment reference number.

- For the other payment options, this P[Number] will automatically be linked to the payment because it is embedded in the barcode, the Pay Now link and the QR Code.

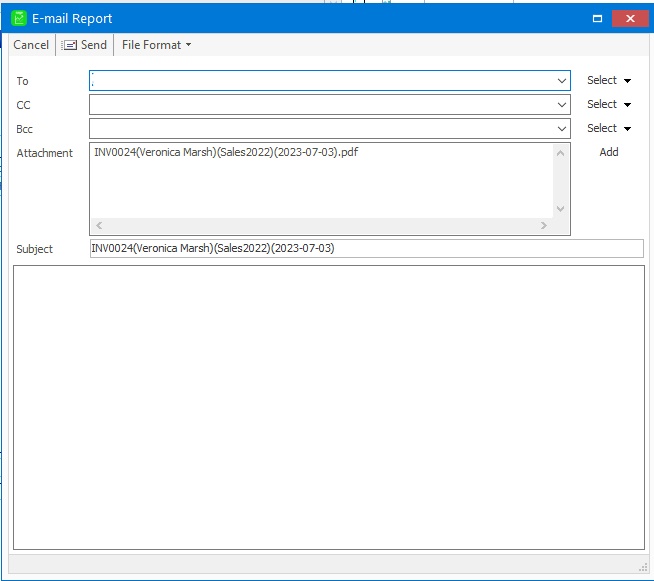

8.The system will also prompt you if you want to email the invoice by displaying the following screen:

9. Enter the recipient’s details in the respective fields and click on the Send button.

How to view your Pay Now report

- Select Services > Pay Now

- Click on Reports > Processed Transactions.

- Choose the date range for the data that you require.

- By clicking on the icon to the left of the transaction, additional information is displayed.

- Reports can be downloaded in Excel (XLS button) or use the Download button for a PDF version of the report.

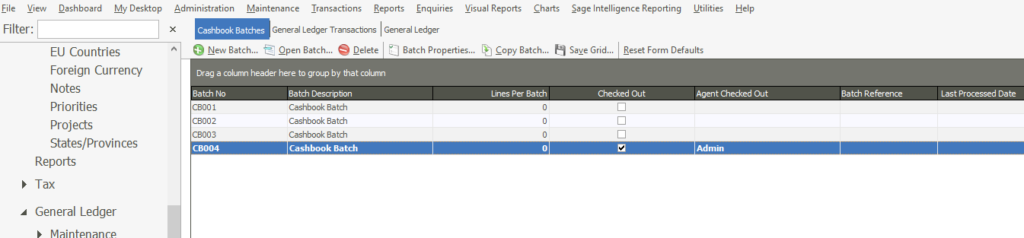

Import your Netcash Bank Statement using Bank Manager

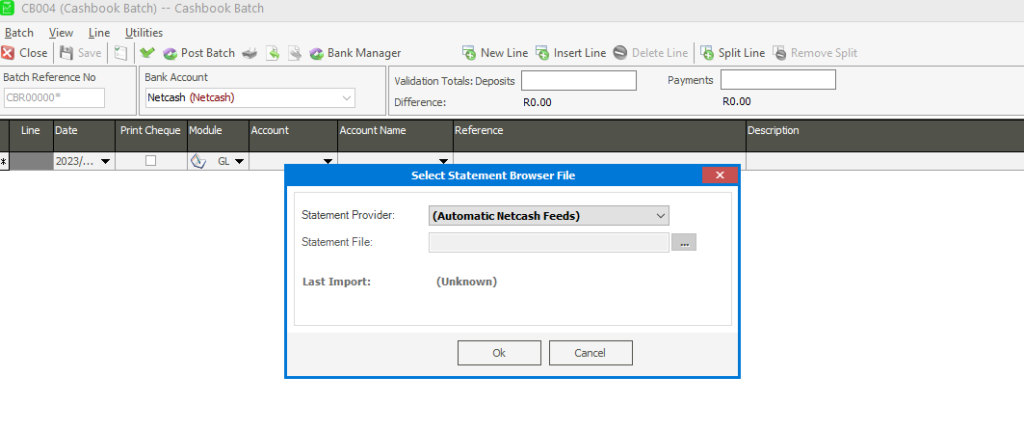

- Navigate to General Ledger | Transactions | Cashbook Batches.

- Select your Netcash Cashbook from the list or create a dedicated Netcash Cashbook.

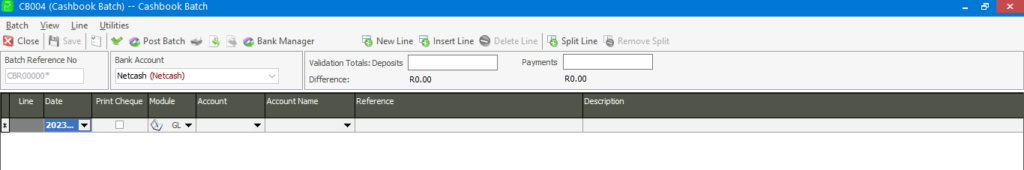

3. When the cashbook is opened, it will display as follows:

4. Click on the Bank Manager button.

5.The following screen displays:

6. Select the Automatic Netcash Feeds layout from the drop down menu.

7. Click on the OK button.

8. Bank Manager will open showing a summary of the statement:

9. Click on the Continue button.

10. The transactions will populate into the Statement Preview grid. Use the Bank Manager functions to perform mappings, import, or export actions and to submit the statement into Sage 200 Evolution.

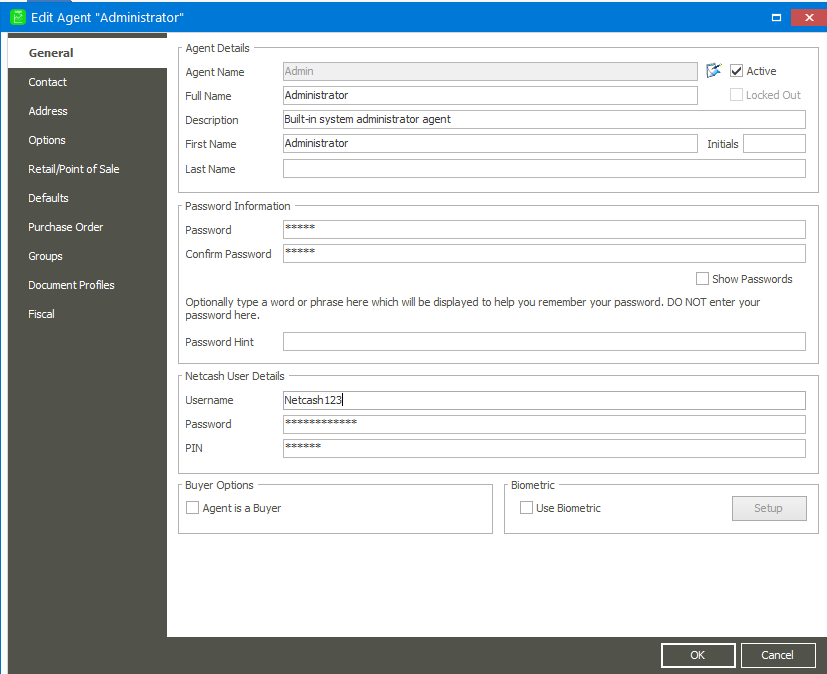

Update an Agent’s details

Adding an Agents details gives that user access to the Netcash App which allows certain Netcash functions to be performed within Sage 200 Evolution.

1. Navigate to Administration | Agents.

2. Create a new agent or edit an existing agent.

3. On the General tab, in the Netcash User Details section of the screen, enter your Netcash access details.

4. Netcash would have provided you with the following information:

- Username

- Password

- PIN number

5.Click on ok to save the changes.

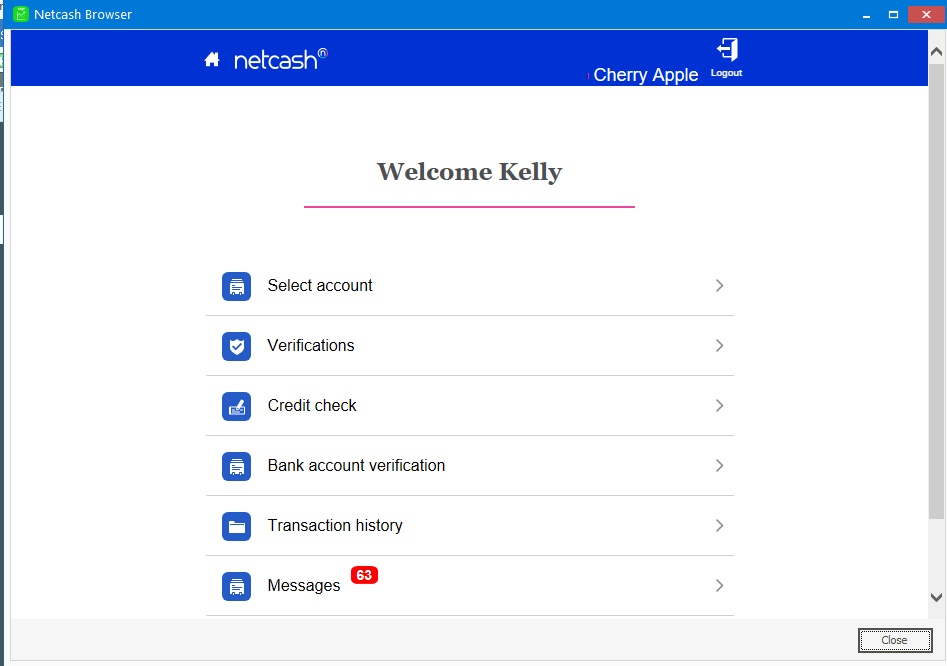

Suppliers and customer Risk Report services.

- If you want to perform a credit check, ID number validations or a manual bank account verification, click on the Debtors or Creditors Service button.

- When this button is clicked, it will reroute you to the Netcash service page.

- You can perform your checks and validations by selecting the required service icon on the Netcash page. Please note that some of these services are chargeable.

To authorise the creditor payments, navigate to Suppliers | Transactions and click on the Netcash Account Service in the work area.

Need more assistance?

Contact your Relationship Consultant at 0861 338 338 or email us on support@netcash.co.za