Creditor Payments QSG

Understanding your Creditor payments profile on your Netcash account

The creditor payment profile displays information relating to your limits, authorises and fees. These payment limits can be increased by you if you have permission to do so.- Service active: This would be ticked if the service is active.

- Line limit: This would reflect the amount of your line limit/you are per transaction limit.

- Batch limit: This would reflect the amount of your batch limit/ this would be your daily limit.

- Number of authorisers: This would reflect how many authorises you have requested; you can have multiple authorises should your business require it.

- Fees are displayed per service.

Our easy to use guide will get you up and running in no time!

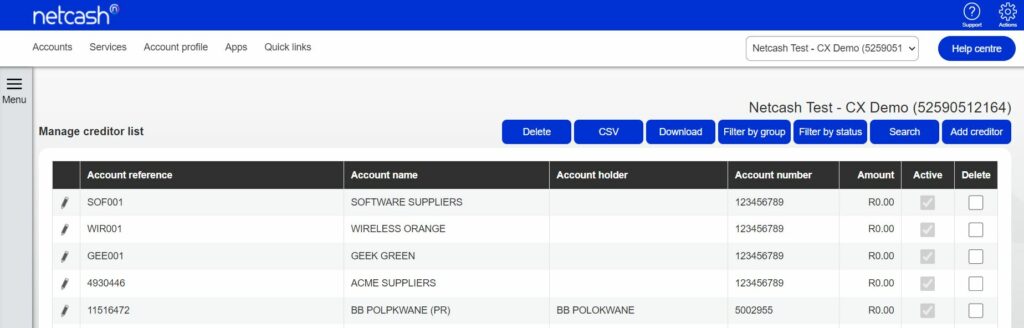

Load creditors

- Select the Services.

- Click on Payments from the dropdown menu.

- Click on Creditors > Creditor List.

- Click the Add creditor button on the top right side of the screen.

- You will be prompted to insert the following information:

– Account reference

– Account name

– Payment amount

– Creditor statement reference

- Click on Submit.

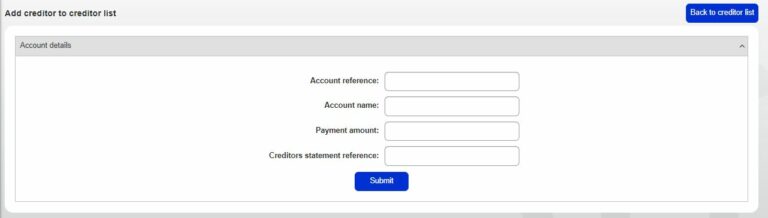

To add the beneficiary’s banking details, click on the Bank account details tab below the Account details.

Pay to a Bank account

- Select the Bank account option

- You will be prompted to insert the following information:

– Bank account name

– Bank account number

– Branch Code

– Bank account type

- Click on Submit.

- Bank account details will be validated before they can be saved

Note: Insert ID number if you would like to verify bank account details.

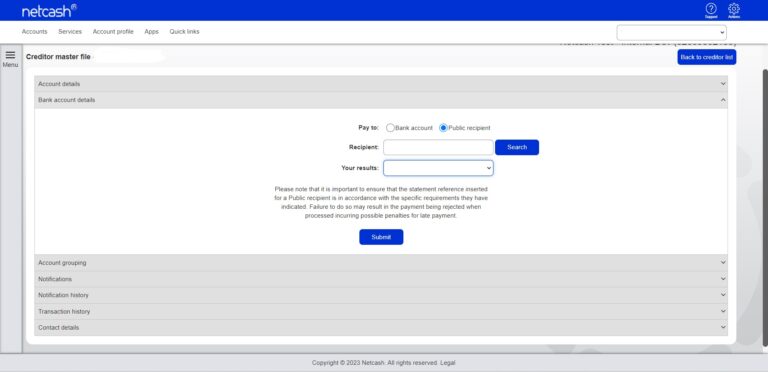

Pay to a Public recipient

- Select the Public recipient option.

- Type in recipient name

- Select the relevant Public recipient from the drop-down list.

- Click on submit.

- Please note that it is important to ensure that the statement reference inserted for a Public recipient is in accordance with the specific requirements they have indicated. Failure to do so may result in the payment being rejected when processed incurring possible penalties for late payment.

Note: Bank account AVS is not available for Public recipients

- The Bank account number displayed for a Public recipient is an identifier ID used for processing and not the Bank account number of the Public recipient.

- Public recipient payments are processed as Sameday payments only.

Other optional fields to store creditor information include:

– Account grouping

– Notifications

– Transaction history

– Contact details

– Creditor notes

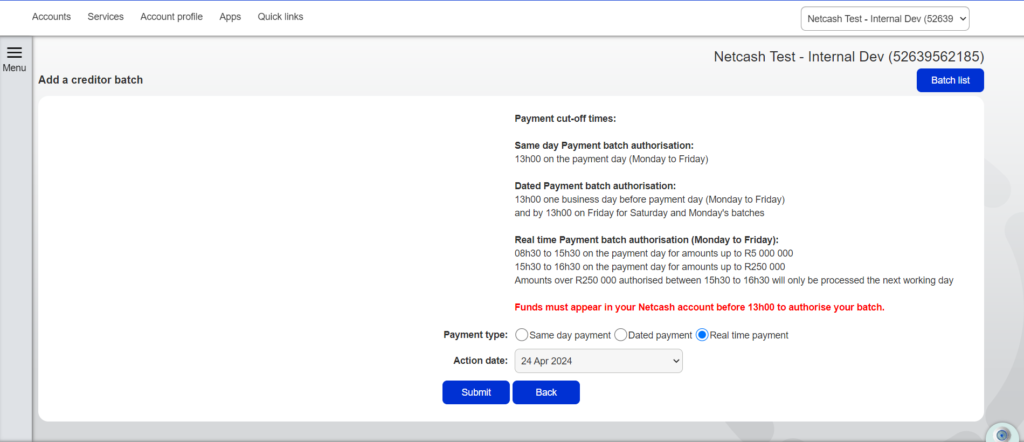

Add a creditor batch

Funds must be available in your Netcash account in order to authorise your batch.

Creditor Payment types and cut off times:

Sameday batches that are in an authorised status on the action date may no longer be unauthorised.

Example:

Sameday batch for action date 29th May can be unauthorised up to and until midnight on 28th May. (Business days only)

Dated batches can only be unauthorised on the business day prior to the cut-off date.

Example

Dated batch for action date 29th May can be unauthorised up and until midnight on the 27th May. (Business days only)

Same day payments

Funds will be available in the beneficiary’s bank account the next day, value-dated for the same day payment date.

The processing cut-off time is 13h00 on the payment day.

Valid payment dates are Monday to Friday (excluding public holidays).

Dated payments

- All payments are reflected in all accounts on the payment day.

- Processing cut-off time is 13h00 one business day before pay day and 13h00 on Friday for Saturday and Monday’s batches.

- Valid payment dates are Monday to Saturday (excluding public holidays).

Real Time Clearing payments(RTC)

Batch authorisation schedules:

Monday to Friday:

- 08h30 15h30 on the payment day for transaction values up to R5 000 000.

- 15h30 to 16h30 on the payment day of transaction values up to R250 000.

RTC batches are not available on weekends or public holidays

Funds must be available in your Netcash account prior to authorisation of the batch.

Public recipients must be excluded from RTC batches.

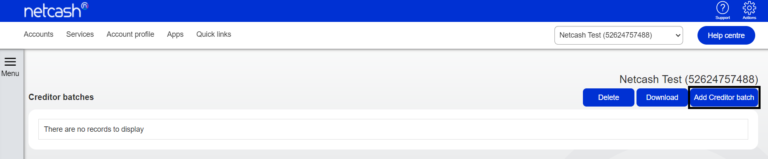

- Select Services.

- Click on Payments from the dropdown menu.

- Click on Creditors > Creditor batches.

- Click on the Add creditor batch button on the top right side of the screen.

Select the *Payment type and Action date.

- Click Submit.

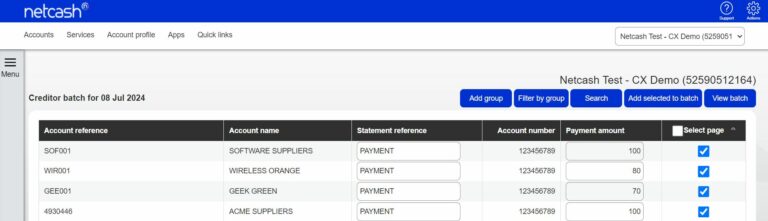

- You may now select beneficiaries to be added to your batch by clicking on the box on the right of the creditor

- Edit amounts and statement references if required.

- Click the Add selected to batch button once all editing/selecting is complete.

- Click on View batch.

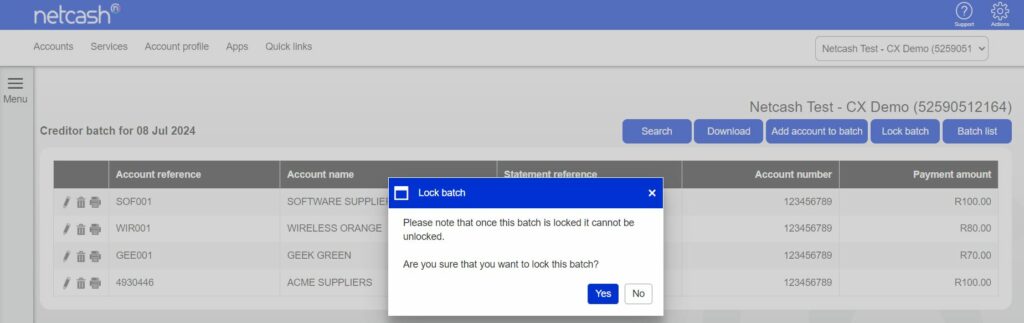

Lock batch

To lock a batch from any further editing select the edit icon and click on Lock batch.

Review the onscreen message and click on Yes if you would like to proceed. Please note that the batch cannot be unlocked.

The lock batch feature is applicable to all batches created on the Netcash platform. Imported batches may have the lock batch feature activated in the NetConnector settings, in which case they will already be locked

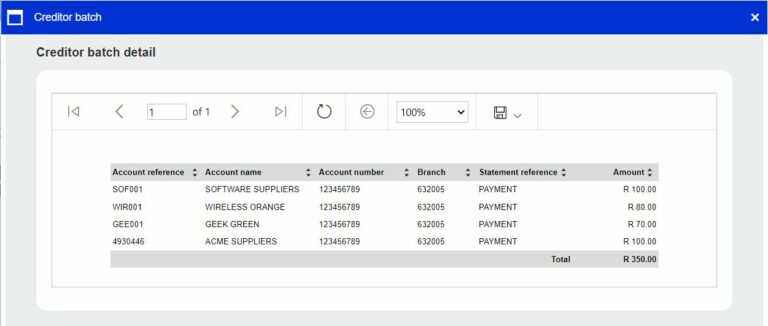

Obtain a pre-authorisation report

- Select Services.

- Select Payments from the dropdown menu.

- Click on Creditors > Creditor batches.

- The list of creditor batches will now be displayed.

- To download your Pre-Authorisation Report, select Edit Creditors on the left side of the Creditor Batch required.

- To download your creditor batch report, click on the Download button.

- Your creditor batch report will be displayed on the screen. Click on the Export icon and select the preferred format to download your report.

- The batch will automatically start downloading and save in your default downloads folder.

Viewing a batch detail report

Navigate to Services > Payments > Creditors > Creditor batches.

Select view batch detail report (left hand side page icon)

The batch detail report displays information regarding batch details prior to the batch being processed by the bank.

Important fields to note:

- Batch value

- Authorised by

- Authorised date

- Action date

- Recommended deposit

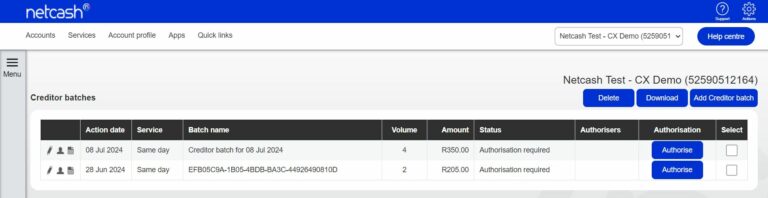

Authorise a creditor batch

- Select Services.

- Select Payments from the dropdown menu.

- Click on Creditors > Creditor batches.

- The list of creditor batches will be displayed.

- Click on the Authorise button next to the batch that you would like to authorise.

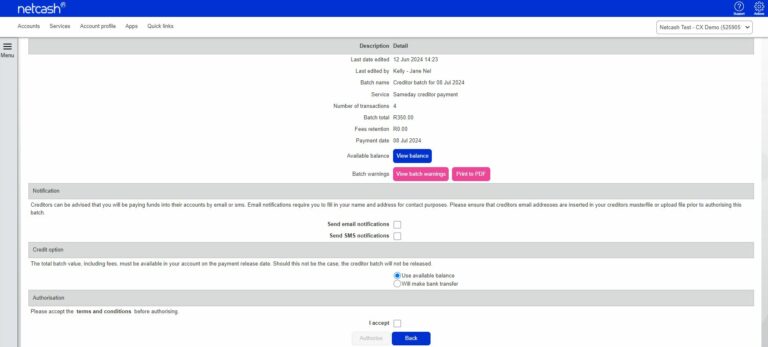

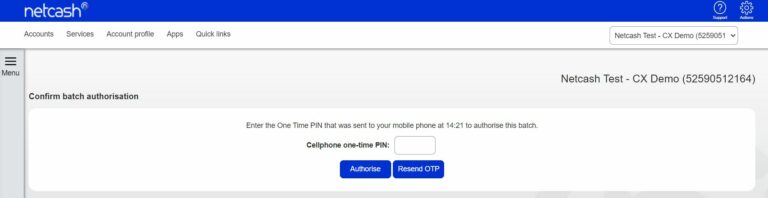

- The Confirm batch authorisation screen is displayed. This is a summary of the creditor batch including charges, notifications, batch warnings example duplicate bank accounts and a choice of funding options:

- Batch warnings -A batch warning button displayed in pink indicates warnings in the batch. Batch warnings will display info in the batch such as duplicate bank accounts and account details changed. You can choose to make corrections or proceed to authorise the batch without amendments

- Use available balance if there is sufficient credit in your Netcash account

- Will make a bank transfer if you need to fund the Netcash clearing account for payment

- Read and accept the terms and conditions, then click on Authorise.

- If Public recipients have been included in a dated creditor payments batch they will be processed as a sameday payment for the action date selected.

- Should you elect to pay using the available balance you will then be re-directed to the Confirm Batch authorisations screen.

- Insert the One Time Pin (OTP) sent to your cell number or Google authenticator pin.

- Click OK.

- Your creditor batch is now authorised and will be scheduled to run on the selected date.

- If you are paying using the Will Make bank transfer option, you will be prompted to insert the following information:

– The date when the transfer will be made

– The Netcash account you will be transferred to

– The amount to be transferred

– The extra fields are optional for reconciliation purposes

- To view the Netcash clearing accounts details in your Netcash account: Navigate to Services > Account> Manage Account> Netcash clearing accounts.

3. Click on Next.

4. Click on a Print Report in order to obtain details of the Netcash clearing that you need to fund.

5. Click Authorise to confirm your bank transfer.

6. Insert the One Time Pin (OTP) sent to your cell number or Google authorisation pin.

7. Your creditor Batch is now authorised and will be scheduled to run on the selected date.

Note: Please ensure your Netcash account number is used as the reference.

Note: One Time Pins are session based. This means that as long as you are logged in to your Sage Pay account, you can use the same OTP to authorise. Where multiple authorisations are required, only the first authoriser needs to insert the OTP.

If you have exceeded your line or batch limit, please contact Netcash to arrange a limit increase or click on the increase limit button during the batch authorisation process, your Relationship Consultant will contact you. If you have permission to increase the limits on the Netcash account, then please follow the below steps:

- Select Account Profile.

- Click on Service profiles.

- Select Salary payments.

- Click on the blue Edit button.

- Adjust your limits accordingly and submit.

- You will receive an OTP to authorise the change.

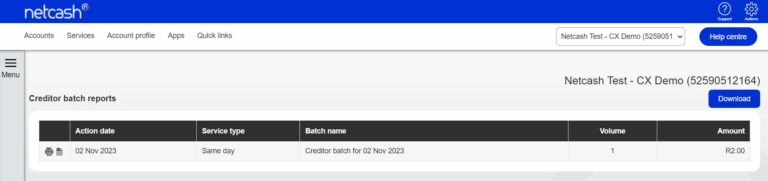

Obtain a post batch authorisation report

- Select the Services.

- Select Payments from the dropdown menu.

- Click on Creditors > Creditor batch reports.

- Click on the Export icon and select the preferred format to download your report.

- The batch will automatically start downloading and save in your default downloads folder.

For more detailed information regarding Creditor payments click on Read more